🚨 BREAKING: Amex India Shifts Reward Multiplier to “ShopWise” (New Fees & Caps)

By Sahil Gulati | February 2, 2026

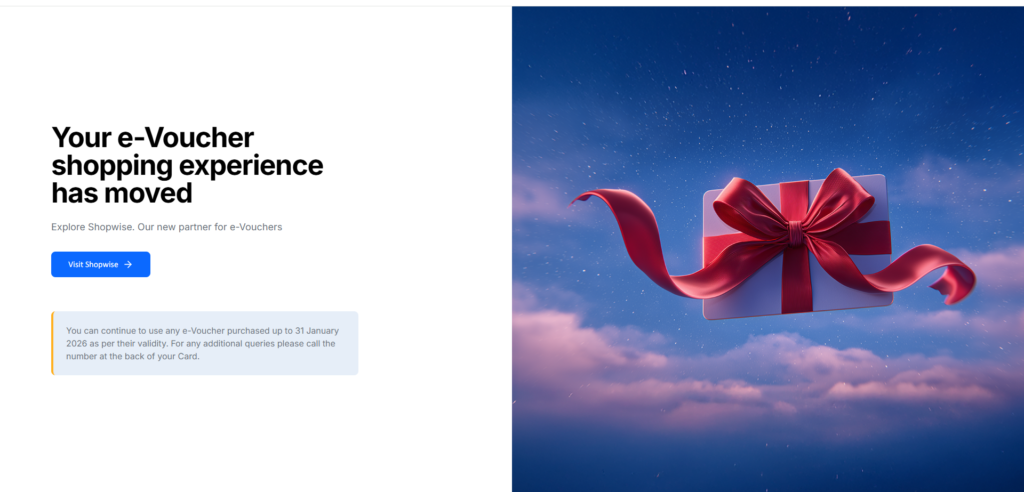

If you tried to buy Amazon Pay or Flipkart vouchers via the Amex Reward Multiplier portal today, you noticed something different. The familiar Gyftr interface is gone, replaced by a new platform called ShopWise.

This isn’t just a visual update. It introduces processing fees and enforces monthly caps that you need to factor into your strategy immediately.

🛍️ What Changed? (Gyftr ➔ ShopWise)

Effective February 1, 2026, American Express India has migrated its voucher ecosystem from Gyftr to ShopWise.

- Old Platform: Gyftr (Amex Reward Multiplier)

- New Platform: ShopWise (powered by Giftstacc/similar aggregator)

- The URL: The redirection now lands you on the ShopWise subdomain for Amex.

🔍 The 3 Key Changes

- Selective Fees: The 1.5% + GST Fee (Total ~1.77%) currently applies primarily to Amazon Pay, Amazon Shopping, and Flipkart. Most other brands (Myntra, Swiggy, Uber, Zomato, etc.) are currently Fee-Free!

- Points on Total: You earn Membership Rewards (MR) on the Gross Amount (Voucher Value + Convenience Fee + GST). You don’t lose out on points for the extra money you pay.

- Monthly Cap: There is a hard cap of 25,000 Bonus Points per month.

Strategy Check: If you are on the Amex Platinum Travel Card, your base reward rate is low. This fee might make buying vouchers for small amounts unviable unless you are hitting the 4 Lakh Milestone.

🛑 The Hard Cap: 25,000 Bonus Points/Month

Amex has explicitly stated the monthly limit on Bonus Points earned through the Reward Multiplier program.

- The Limit: 25,000 Bonus MR Points per month.

- What Counts: This cap applies to the extra points you earn (e.g., the 2X, 3X, or 5X component), not the base points.

- Reset Cycle: Calendar Month.

Multiplier Rates (Unchanged):

- Centurion: 10X

- Platinum Charge / Gold: 5X

- Platinum Travel / Reserve: 3X

- MRCC / Gold Charge: 2X

💳 Is It Still Worth It?

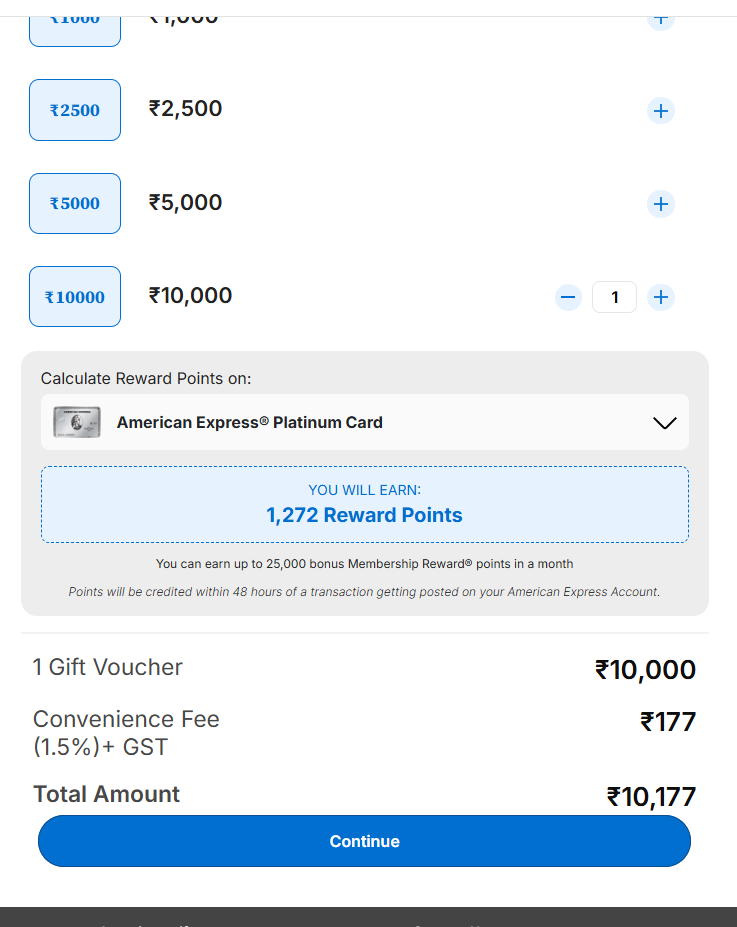

Let’s do the math for an Amex Platinum Travel user buying ₹10,000 Amazon Vouchers on ShopWise.

- Voucher Cost: ₹10,000

- Fee (1.77%): ₹177

- Total Paid: ₹10,177

- Base Points: ~203 MR (approx)

- 3X Multiplier Bonus: ~408 MR (Bonus)

- Total Points: ~611 MR (approx)

- Value: 611 MR is worth approx ₹150–₹300 (depending on redemption).

The Real Value: The value remains in the Milestone Benefits. You still get closer to the 4 Lakh spend target (which gives 40,000 Bonus Points + ₹10k Taj Voucher). Don’t stop spending if you are chasing the milestone, but stop “manufacturing spend” once you’ve hit it.

The Math: Buying ₹10,000 Amazon Pay Voucher on ShopWise

- Voucher Value: ₹10,000

- Convenience Fee (1.5%): ₹150

- GST on Fee (18%): ₹27

- Total You Pay: ₹10,177

- Cost of Acquisition: You are paying ₹177 extra to earn these points.

Card-by-Card Analysis

| Card Variant | Multiplier Rate | Base Points | Bonus Points | Total MR Points | Value of Points (Approx) | Net Profit/Loss (Value – ₹177 Fee) |

| Platinum Charge | 5X | 254 | 1,018 | 1,272 | ₹625 – ₹1,272 | ✅ Profit |

| Gold Charge | 5X | 203 | 815 | 1,018 | ₹500 – ₹1,000 | ✅ Profit |

| Platinum Travel | 3X | 203 | 408 | 611 | ₹150 – ₹300 | ⚠️ Neutral / Loss |

| MRCC | 2X | 201 | 206 | 407 | ₹100 – ₹200 | ❌ Loss |

> Point Valuation: Conservative ₹0.50/pt (Statement Credit/Taj) to Aggressive ₹1.00/pt (Marriott/Miles).

The Verdict for Each Card

1. Amex Platinum Charge (Metal)

- Verdict: Still Worth It.

- Why: You earn 1,272 points for a ₹177 fee. Even at a conservative value, you are coming out ahead. If you transfer to Marriott or Airlines, the return is excellent (approx 6-10%).

2. Amex Gold Charge

- Verdict: Still Worth It.

- Why: Similar to the Platinum Charge, the 5X multiplier absorbs the fee easily. Earning 1,018 points for ₹177 is a cheap way to “buy” miles.

3. Amex Platinum Travel

- Verdict: STOP (unless chasing milestone).

- Why: You only earn ~611 points (worth ~₹150-₹300). You are paying ₹177 in fees. The math is barely break-even.

- Strategy: Only use this method if you are falling short of the 4 Lakh Milestone. The 40,000 bonus points + ₹10k Taj voucher at the milestone justifies the small fee, but purely for regular spend, it’s no longer attractive.

4. Amex MRCC

- Verdict: HARD STOP.

- Why: You earn ~407 points (worth ~₹100-₹200) but pay ₹177. You are effectively losing money.

- Strategy: Stop buying vouchers on ShopWise for the 2X benefit. Instead, focus on the 1,500 x 4 transactions or ₹20k Monthly Goal on other platforms (like direct utility payments or wallet loads if applicable) to trigger the monthly bonuses.

📝 Action Items

- Check the Fee: Before paying, look at the final cart amount on ShopWise.

- Track Your Cap: If you are a heavy spender (e.g., buying ₹1 Lakh+ vouchers a month), stop once you hit the 25,000 bonus point limit.

- Use Direct Spend: For brands like Myntra or Swiggy, check if buying directly gives you better value than paying the 1.77% surcharge.