Review: BOBCARD Etihad Guest Premium – The New King of International Spends?

Verdict: ⭐⭐⭐⭐½

Best For: Frequent international travelers, Etihad loyalists, and anyone tired of paying 2-3.5% forex fees.

The Indian credit card market has been stagnant on co-branded airline cards for a while, with SBI holding the monopoly on Etihad. That changed in December 2025 with the launch of the BOBCARD Etihad Guest Premium.

While most co-branded cards are “sock drawer” cards used only for booking tickets on that specific airline, BOBCARD has disrupted the market by adding a feature we rarely see on airline cards: 0% Forex Markup.

Here is the deep dive.

1. The Two Variants

BOBCARD has launched two versions. It is crucial to choose the right one.

- BOBCARD Etihad Guest Premium: The hero product. 0% Forex, higher earn rate.

- BOBCARD Etihad Guest (Base): Entry-level. 1% Forex, lower earn rate.

Recommendation: Stick to the Premium variant. The 0% forex benefit alone outweighs any difference in annual fees.

2. The “Killer Feature”: 0% Foreign Currency Markup

This is the headline.

- The Industry Standard: Most premium cards (HDFC Infinia, Amex Platinum) charge 2% + GST. The SBI Etihad Guest Premier charges 3.5% + GST.

- The BOBCARD Advantage: You pay 0% markup.

- The Math: On a ₹1 Lakh international hotel booking or shopping spree:

- SBI Etihad Premier: You pay ~₹1,04,130.

- HDFC Infinia: You pay ~₹1,02,360.

- BOBCARD Etihad Premium: You pay ₹1,00,000.

Dealuni Take: This makes the BOBCARD Etihad Premium the best card in India for general spending abroad, beating even the mighty Infinia in terms of immediate cash outflow.

3. Reward Rates (The Miles Game)

The card earns Etihad Guest Miles directly. No transfer ratios, no conversion delays.

| Spend Category | Earn Rate (Premium) | Value (approx @ ₹0.80/mile) |

| Etihad Airways | 6 Miles / ₹100 | ~4.8% |

| International Spends | 2 Miles / ₹100 | ~1.6% |

| Domestic Spends | 2 Miles / ₹100 | ~1.6% |

- International Sweet Spot: You earn 2 Miles/₹100 AND pay 0% forex. This is a “double dip” of value that is hard to beat.

- Domestic Weakness: 2 Miles/₹100 is decent, but not industry-leading (Atlas or Infinia beat this). Use this card primarily for international travel and Etihad bookings.

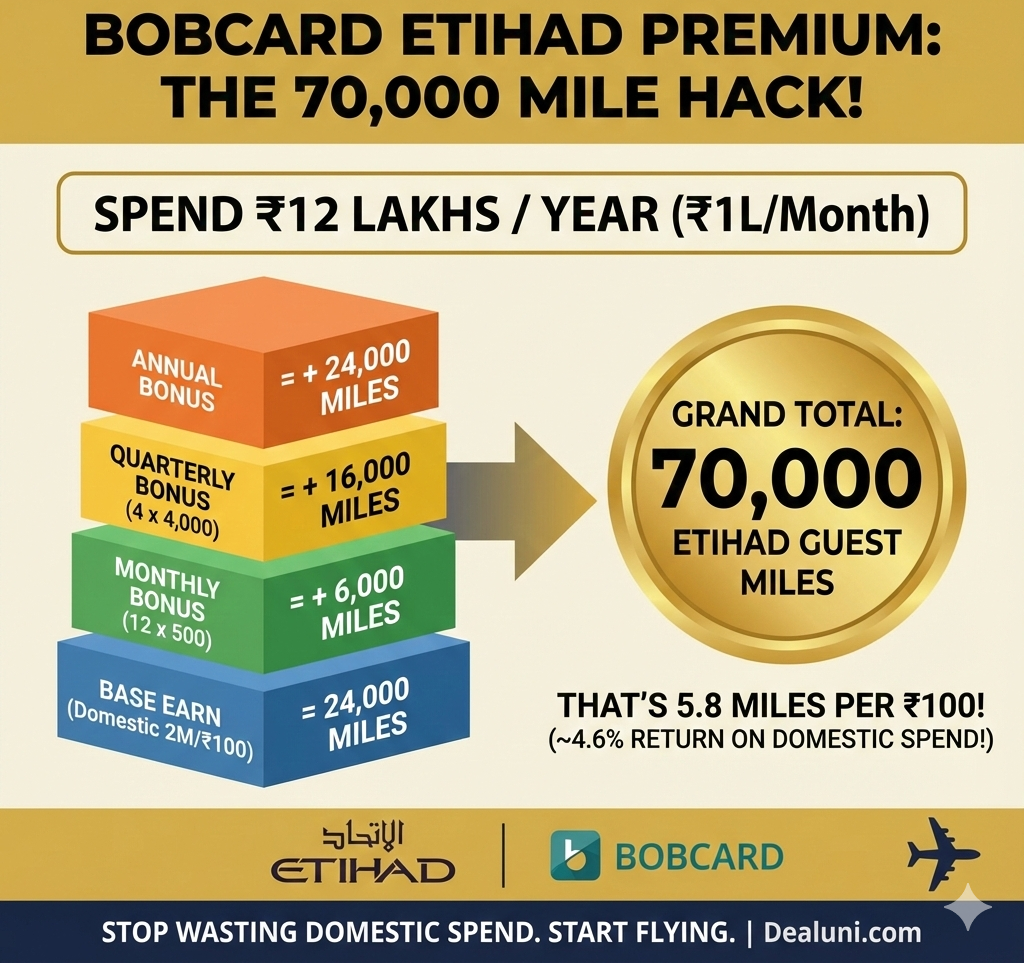

4. Milestone Benefits: The “Ladder”

1. The Stackable Bonuses | Milestone Type | Target Spend | Bonus Reward | Frequency | Monthly | ₹50,000 (across 4+ txns) | 500 Miles | 12x / year | | Quarterly | ₹3,00,000 | 4,000 Miles | 4x / year | | Annual | ₹12,00,000 | 24,000 Miles | 1x / year | | Flight Bonus | Fly Etihad 2x / year | 1,000 Miles | 1x / year |

2. The Dealuni “Sweet Spot” Analysis If you are a heavy spender (₹1 Lakh/month), this card transforms from a “Travel Card” into a Reward Machine. Here is the math if you spend exactly ₹12 Lakhs in a year (split evenly):

- Base Earn: 24,000 Miles (assuming min. domestic rate of 2 Miles/₹100)

- Monthly Bonuses: 6,000 Miles (500 x 12)

- Quarterly Bonuses: 16,000 Miles (4,000 x 4)

- Annual Bonus: 24,000 Miles

- Total Earn: 70,000 Etihad Guest Miles

Result: On ₹12L spend, you earn 70k miles. That is a return rate of 5.8 Miles per ₹100 on domestic spending. Valuation: At a conservative ₹0.80 per mile, that is a ~4.6% return on domestic spend, which rivals the HDFC Infinia.

5. Lounge Access

- Domestic: 12 Complimentary visits per year (capped at 3/quarter).

- International: 8 Complimentary visits per year (capped at 2/quarter).

- Note: For a “Premium” travel card, the international cap is slightly low compared to the Dreamfolks unlimited cards, but sufficient for 1-2 international trips a year.

6. Head-to-Head: BOBCARD Premium vs. SBI Premier

| Feature | BOBCARD Etihad Premium | SBI Etihad Premier |

| Forex Markup | 0% (Winner) | 3.5% |

| Etihad Earn | 6 Miles/₹100 | 6 Miles/₹100 |

| Gen. Intl Earn | 2 Miles/₹100 | 4 Miles/₹100 |

| Big USP | Savings on Spend | Companion Voucher |

| Network | Rupay | Visa Signature |

The Strategic Pivot:

- Keep the SBI card if you spend exactly ₹8 Lakhs to trigger the Companion Voucher (free ticket).

- Get the BOBCARD for actual spending abroad. Using the SBI card internationally burns 3.5% of your money, negating the value of the miles earned.

Dealuni Verification: Should YOU Apply?

YES, if:

- You have an international trip coming up: (e.g., Vietnam, Europe). The 0% forex will save you thousands instantly.

- You fly Etihad often: The 6x miles and Tier status are excellent.

- You want to diversify points: If you are heavy on Marriott/Accor points, earning direct Airline Miles is a good hedge.

- If you can spend ₹12 Lakhs a year, this card is no longer just for international trips. The “Stacking Bonuses” make it a powerful primary driver for accumulating Etihad miles, offering a ~4.6% return even on boring domestic expenses like insurance or utilities (assuming they count toward the spend targets).

NO, if:

- You never travel abroad: There are better domestic cashback or rewards cards (like SBI Cashback or Amex MRCC).

- You want flexible points: These miles are locked to Etihad. If you prefer flexibility, stick to Amex Platinum or Axis Atlas.