Axis Bank Magnus (Burgundy & Standard) and Axis Atlas: Unpacking India’s Premium Travel Credit Cards

In the fiercely competitive realm of premium credit cards, Axis Bank has consistently made its mark with offerings designed to capture the discerning Indian traveler. At the forefront of this strategy are the Axis Bank Magnus Credit Card – available in both its exclusive Burgundy Customer variant and the Standard version – and the popular Axis Bank Atlas Credit Card. Each of these cards has carved out a unique space, offering compelling reward structures, unparalleled transfer opportunities, and a suite of travel and lifestyle benefits.

However, the world of credit card rewards is a dynamic one, constantly evolving with benefit revisions and policy updates. This comprehensive review aims to provide an up-to-date and in-depth analysis of all three cards as they stand today. We’ll delve into their fees, current reward structures, powerful transfer partners, and the luxurious lifestyle benefits they offer. Crucially, we’ll also examine the past glory of benefits that are no longer active and preview upcoming changes to paint a complete picture of their true value.

Whether you’re a high-spending individual, a frequent flyer, or a smart traveler looking to maximize every rupee, understanding the nuances of these Axis Bank cards is key to unlocking exceptional value. Join us as we unpack what makes (or made) these cards stand out, helping you decide which, if any, deserves a prime spot in your wallet.

Excellent! The new introduction sets the stage perfectly, acknowledging Atlas’s current availability and the dynamic nature of credit card benefits.

Now, let’s dive into the flagship card of this review: the Axis Bank Magnus for Burgundy Customers. We’ll start by highlighting its incredible past value, which really built its reputation, before detailing its (still very strong) current benefits.

Axis Bank Magnus Credit Card (for Burgundy Customers): A Legacy of Power, A Present of Privilege

The Axis Bank Magnus Credit Card for Burgundy Customers has, for a long time, been whispered about in elite circles of credit card enthusiasts. For those who meet Axis Bank’s stringent Burgundy eligibility criteria – typically a significant relationship value with the bank (₹10 Lakhs MAB, ₹30 Lakhs in FD, or ₹1 Crore in TRV) – this card unlocked a level of reward maximization that few others could match.

A Glimpse into Past Glory: The Legendary Monthly Milestone (Until August 2024)

For a considerable period, the Magnus was an undisputed king, primarily due to an exceptional benefit that drove its immense popularity:

- 25,000 EDGE REWARD points on spending ₹1 Lakh in a calendar month.

This monthly milestone was revolutionary. By simply spending ₹1 Lakh, cardholders effectively earned 25,000 extra points on top of their base rewards. When transferred to partner airlines or hotels at the Burgundy variant’s highly favorable 5:4 ratio, this single benefit could yield an astounding 20,000 airline miles or hotel points every month, costing less than ₹1 Lakh in spend. This enabled rapid accumulation of points for aspirational first-class flights or luxury hotel stays, cementing its reputation as a points-earning powerhouse. This benefit, however, was discontinued effective August 2024, marking a significant shift in the card’s overall value proposition.

Current Value Proposition: Still a Force to Be Reckoned With?

Despite the removal of its most celebrated monthly milestone, the Axis Bank Magnus for Burgundy Customers remains a formidable premium card, offering a suite of benefits tailored for high-net-worth individuals and frequent travelers.

1. Fees & Eligibility:

- Joining Fee: ₹30,000 + GST

- Annual Fee: ₹30,000 + GST (Waived on annual spends of ₹30,00,000 in the preceding year, or automatically for Burgundy Private customers).

- Eligibility: Exclusive to Axis Bank Burgundy Customers (requiring a significant banking relationship as defined by the bank).

2. Reward Structure:

- Standard Earn: Earn 12 EDGE REWARD points per ₹200 spent on all domestic and international transactions. This translates to an effective base reward rate of 6% (assuming 1 ER = ₹0.20 for statement credit/cash equivalent).

- Accelerated Earn on Travel Edge: A standout current feature is the accelerated 60 EDGE REWARD points per ₹200 spent when booking flights, hotels, or experiences via the Axis Travel Edge portal. This is a phenomenal 30% reward rate on travel portal spends, significantly boosting point accumulation for travel booked through Axis Bank.

- Excluded Spends: Transactions on Utility & Telecom, Rent (capped at ₹50,000 per month), Wallet, Government spends, Insurance, Gold & Jewellery, Fuel, Cash advances, and Repayments are excluded from earning rewards.

3. Points Transfer Powerhouse (5:4 Ratio):

- This is where the Burgundy Magnus truly shines currently. EDGE REWARD points can be transferred to a wide array of international airline and hotel loyalty programs at an exceptional ratio of 5 EDGE REWARD points = 4 partner miles/points.

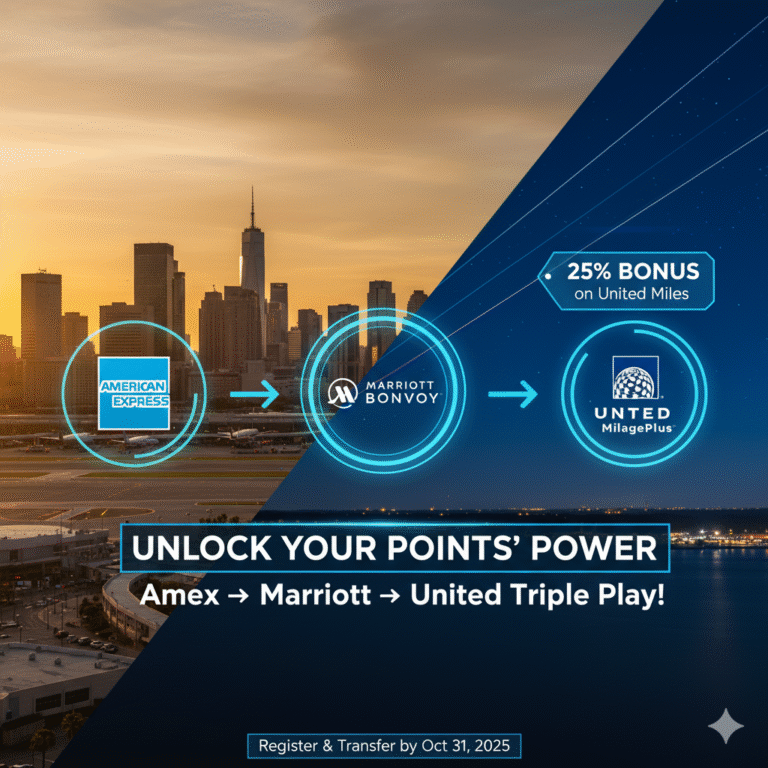

- Partners include: Marriott Bonvoy, Accor Live Limitless, ITC Hotels Club ITC, Qatar Airways Privilege Club, United MileagePlus, Air Canada Aeroplan, Etihad Guest, Singapore Airlines KrisFlyer, Vistara Club Vistara, and many more. This superior transfer ratio allows for premium redemptions for flights and luxury hotel stays.

4. 2% Forex Markup:

- 2% cross-currency markup on all international transactions.

5. Unlimited Lounge Access (International & Domestic):

- International: Experience unlimited complimentary international lounge access for both the primary cardholder and 4 guests visit/year via Priority Pass. This is a top-tier benefit, perfect for families or business travelers.

- Domestic: Enjoy unlimited complimentary domestic airport lounge access for the primary cardholder. ( From 1st May 2024, the unlimited Domestic lounge will be based on a minimum spend of Rs. 50000 in the previous 3 months)

6. Lifestyle Benefits:

- Movie & Event Tickets: Get Buy One Get One Free on movie or non-movie tickets via BookMyShow, up to ₹500 off on the second ticket, twice per month (maximum benefit ₹1,000 per month).( Stopped now)

- Dining Delights: Up to 20% off at partner restaurants.

- Concierge Services: Access to 24/7 complimentary concierge service for travel, dining, and other lifestyle assistance.

Pros & Cons (Axis Bank Magnus for Burgundy Customers):

Pros:

- Exceptional 5:4 transfer ratio to a wide range of airline and hotel partners.

- Phenomenal 60 ER per ₹200 (30% equivalent) on Axis Travel Edge bookings.

- 2% Forex Markup for international spending.

- Unlimited international lounge access for cardholder + 4 Guest Visits/year.

- Earning 35ER per ₹200 on spends about ₹1.5L till( credit limit + ₹1.5Lakhs).

Cons:

- High annual fee (₹30,000 + GST).

- Strict Burgundy eligibility criteria.

- ₹5000 Voucher Welcome Benefit for New Customers.

- Significant loss of the 25,000 ER monthly milestone benefit (discontinued Aug 2024), which was its biggest USP.

- Upcoming devaluations in standard reward earning (effective June 2025).

Axis Bank Magnus Credit Card (Standard Variant): Premium Perks for All?

“While the Burgundy Magnus caters exclusively to Axis Bank’s high-value customers, the Standard Axis Bank Magnus Credit Card aims to bring a premium rewards experience to a broader segment. While it shares many features with its Burgundy counterpart, critical differences in its reward mechanics and transfer ratio distinguish its value proposition.

Understanding the Standard Magnus’s Current Offering:

Similar to the Burgundy variant, the Standard Magnus also underwent a significant shift with the discontinuation of its monthly milestone benefit. However, it still offers strong benefits for its fee structure.

1. Fees:

- Joining Fee: ₹12,500 + GST

- Annual Fee: ₹12,500 + GST (Waived on annual spends of ₹25,00,000 in the preceding year).

2. Reward Structure:

- Standard Earn: Earn 12 EDGE REWARD points per ₹200 spent on all domestic and international transactions. (Equivalent to a 6% base reward rate).

- Accelerated Earn on Travel Edge: Like the Burgundy version, it also offers a generous 60 EDGE REWARD points per ₹200 spent when booking flights, hotels, or experiences via the Axis Travel Edge portal. This remains a high-value redemption avenue.

- Excluded Spends: Same categories as the Burgundy variant (Utility & Telecom, Rent (capped at ₹50,000 per month), Wallet, Government spends, Insurance, Gold & Jewellery, Fuel, Cash advances, and Repayments).

3. Points Transfer (The Key Difference: 5:2 Ratio):

- This is the primary distinction from the Burgundy variant. For the Standard Magnus, EDGE REWARD points can be transferred to a wide array of international airline and hotel loyalty programs at a ratio of 5 EDGE REWARD points = 2 partner miles/points.

- While not as lucrative as the 5:4 Burgundy ratio, this 5:2 ratio can still yield decent value, particularly if utilized for strategic airline redemptions or during transfer bonuses.

4. Forex Markup:

- Unlike the Burgundy variant, the Standard Magnus carries a 2% cross-currency markup on all international transactions. This is an important consideration for frequent international travelers.

5. Lounge Access:

- International: Enjoy unlimited international airport lounge access with 4 guest visits per year via Priority Pass. This is a robust offering for a card in its segment.

- Domestic: Enjoy unlimited complimentary domestic airport lounge access for both primary cardholder. ( From 1st May 2024, the unlimited Domestic lounge will be based on a minimum spend of Rs. 50000 in the previous 3 months)

6. Lifestyle Benefits:

- Movie & Event Tickets: Get Buy One Get One Free on movie or non-movie tickets via BookMyShow, up to ₹500 off on the second ticket, twice per month (maximum benefit ₹1,000 per month).( Stopped now)

- Dining Delights: Up to 20% off at partner restaurants.

- Concierge Services: Access to 24/7 complimentary concierge service.

Pros & Cons (Axis Bank Magnus – Standard Variant):

Pros:

- Solid 60 ER per ₹200 (30% equivalent) on Axis Travel Edge bookings.

- Unlimited lounge access benefits.

- More accessible than the Burgundy variant (no specific banking relationship required).

- Rs. 12500 worth of a Voucher is given as a Welcome Benefit currently.

Cons:

- Significant loss of the 25,000 ER monthly milestone benefit (discontinued Aug 2024), which was its biggest USP.

- Less attractive 5:2 transfer ratio compared to Burgundy Magnus.

- 2% Forex Markup makes international spending expensive.

- Upcoming devaluations in standard reward earning (effective June 2025).

Axis Bank Atlas Credit Card: The Unsung Hero for Smart Travelers?

“While the Magnus cards cater to high-spenders with broad travel aspirations, the Axis Bank Atlas Credit Card carved out a unique and highly respected niche among smart travelers, particularly those focused on hotel redemptions. Despite rumors of its discontinuation, its continued presence on Axis Bank’s platforms and active application process suggest it remains a viable, albeit distinct, option for points maximizers.

The Atlas card’s strength lies in its straightforward reward structure and an exceptionally valuable transfer ratio that directly benefits hotel stays.

Understanding the Atlas Card’s Current Offering:

1. Fees:

- Joining Fee: ₹5,000 + GST

- Annual Fee: ₹5,000 + GST

2. Welcome Benefit:

- Earn 2,500 EDGE MILES on your first transaction within 37 days of card issuance. This provides a good head start on your rewards journey.

3. Reward Structure:

- Standard Earn: Earn 2 Edge Miles per ₹100 spent on domestic transactions.

- Accelerated Earn (International & Travel): Earn 5 Edge Miles per ₹100 spent on international transactions and on airline/hotel websites/apps (direct bookings). This is a strong 5% reward rate (assuming 1 EM = ₹1 for direct redemption) for key travel spends.

- Excluded Spends: Standard exclusions apply, similar to Magnus (e.g., Utility, Rent, Wallet, Fuel, Government, Cash advances, Gold & Jewellery, Insurance, Repayments).

4. Annual Milestone Benefits & Tiers (Silver, Gold, Platinum):

- The Atlas card uniquely rewards consistent annual spending by upgrading your tier and providing bonus Edge Miles:

- Silver Tier: Achieved on annual spends of ₹3 Lakhs.

- Bonus: 2,500 Edge Miles.

- Benefits: Access to exclusive offers.

- Gold Tier: Achieved on annual spends of ₹7.5 Lakhs.

- Bonus: 5,000 Edge Miles.

- Benefits: Enhanced exclusive offers.

- Platinum Tier: Achieved on annual spends of ₹15 Lakhs.

- Bonus: 10,000 Edge Miles.

- Benefits: Premium exclusive offers.

- Silver Tier: Achieved on annual spends of ₹3 Lakhs.

- These tiers provide significant bonus points and escalating benefits,making the card increasingly rewarding as your spending grows.

5. Points Transfer (The Game Changer: 1:2 Ratio for Hotels):

- This is where Atlas truly shone and continues to hold unique value. EDGE MILES can be transferred to a variety of partner airline and hotel loyalty programs at an incredible ratio of 1 Edge Mile = 2 partner miles/points.

- Primary Benefit: This ratio is exceptionally powerful for hotel programs like Marriott Bonvoy. For example, 10,000 Edge Miles could become 20,000 Marriott Bonvoy points, making luxury hotel redemptions highly achievable. While it works for airlines too, its strength was most pronounced for hotels.

6. Forex Markup:

- Enjoy a competitive 2% cross-currency markup on all international transactions.

7. Lounge Access:

- International: Get 4 complimentary international lounge visits per calendar year via Lounge Key, which increases with Tier Benefits.

- Domestic: Get 8 complimentary domestic lounge visits per calendar year via Lounge Key, which increases with Tier Benefits. (Total 12 visits split between domestic/international). This is a solid offering for a card at this fee level.

8. Lifestyle Benefits:

- While not as extensive as Magnus, it often includes dining discounts and other basic benefits.

Pros & Cons (Axis Bank Atlas Credit Card):

Pros:

- Exceptional 1:2 transfer ratio for Edge Miles to partner loyalty programs, especially valuable for hotel redemptions (e.g., Marriott Bonvoy).

- Competitive 2% Forex Markup.

- Strong accelerated earn of 5 Edge Miles per ₹100 on direct travel bookings and international spends.

- Attainable annual milestone benefits provide significant bonus points.

- Lower annual fee (₹5,000 + GST) makes it more accessible.

- Good lounge access benefits (8 domestic + 4 international).

Cons:

- Reward earning is in “Edge Miles,” a distinct currency from “Edge Rewards” (Magnus), requiring careful management.

- Limited lifestyle benefits compared to Magnus.

- No BOGO movie offers.

- While still available, its future issuance can be subject to change without prior notice (as suggested by past rumors).

Axis Bank GrabDeals – Maximizing Everyday Savings

“Beyond the core rewards and travel benefits, Axis Bank also extends everyday value to its cardholders through GrabDeals. This is an exclusive program that offers instant discounts or cashback when using your Axis Bank credit or debit card for online transactions with a wide array of partner merchants. From e-commerce giants to food delivery, travel portals (beyond Travel Edge), and lifestyle brands, GrabDeals provides an additional layer of savings directly at the point of purchase. It’s a useful perk for all Axis cardholders, allowing you to maximize value on daily spends and stack benefits alongside your card’s standard reward earnings.”

Understanding Loyalty Transfer Limits (Category A & B)

“For serious points maximizers, understanding the nuances of points transfers is paramount. Both Axis Bank Magnus and Atlas cards operate under a system that categorizes transfer partners into Category A and Category B, each with specific limits on how many points you can transfer annually. This is a critical factor for high spenders planning large redemptions.

Loyalty Transfer Categories & Limits (Applicable to Magnus & Atlas EDGE REWARDS / EDGE MILES):

- Category A Partners: These typically include the most popular and high-value airline and hotel programs.

- Annual Transfer Limit: Cardholders can transfer a maximum of 2,00,000 (2 Lakhs) points Edge Rewards for Magnus and 30000 points for Edge Miles for Atlas to Category A partners per calendar year.

- Category B Partners: These comprise the remaining partner programs.

- Annual Transfer Limit: Cardholders can transfer a maximum of 8,00,000 (8 Lakhs) points Edge Rewards for Magnus and 120000 points Edge Miles for Atlas to Category B partners per calendar year.

- Category A Partners: Air Canada Aeroplan, Japan Airlines Mileage Bank, Ethiopian Airlines ShebaMiles, Etihad Guest, Qatar Airways Privilege Club, Singapore Airlines KrisFlyer, Turkish Airlines Miles&Smiles, United MileagePlus, Accor Live Limitless, Marriott Bonvoy, Thai Airways Royal Orchid Plus, Wyndham Rewards.

- Category B Partners: Air France-KLM Flying Blue, Air India (Flying Returns), Air Asia, ITC Gren Points,IHG Hotels & Resorts, Qantas Frequent Flyer, Spicejet

What this means for you:

- Total Annual Transfer Limit: This effectively means a maximum of 10,00,000 (10 Lakhs) points can be transferred out of your Axis Magnus credit card and 1,50,000 for Edge Miles from Axis Atlas Card to loyalty partners in a single calendar year.

- Strategic Planning: If you’re a very high spender, hitting this limit is possible, especially with the accelerated earnings of Magnus or the strong Atlas ratios. It requires careful planning to distribute your transfers across different partners and categories, or to stagger large redemptions across calendar years.

- Transfer Charges: Always transfer in bulk and be sure where you are transferring, as once transferred, you cannot do anything. There is a Redemption charge from 1st Jan 2025, Rs 199+GST

Comparison: Axis Magnus (Burgundy & Standard) vs. Axis Atlas – Who Reigns Supreme?

Having delved deep into each card’s intricacies, it’s clear that the Axis Bank Magnus (both variants) and Axis Bank Atlas cater to different, albeit sometimes overlapping, profiles of premium cardholders. While all aim to deliver exceptional travel value, their mechanics, costs, and ultimate utility vary significantly. Let’s compare them across key parameters to help you determine which card aligns best with your spending and redemption strategy.

Key Differentiators at a Glance:

| Feature | Axis Magnus (Burgundy Customer) | Axis Magnus (Standard) | Axis Atlas |

| Eligibility | Burgundy Banking Relationship | General Premium | General Premium |

| Joining Fee (+GST) | ₹30,000 | ₹12,500 | ₹5,000 |

| Annual Fee (+GST) | ₹30,000 (Waivable ₹30L spend/Burgundy) | ₹12,500 (Waivable ₹25L spend) | ₹5,000 |

| Welcome Benefit | None | Rs. 12,500 Voucher | 2,500 Edge Miles (on 1st transaction) |

| Monthly Milestone | None (Discontinued Aug 2024) | None (Discontinued Aug 2024) | N/A (Has Annual Milestone Tiers) |

| Base Earn Rate | 12 ER / ₹200 | 12 ER / ₹200 | 2 EM / ₹100 (Domestic); 5 EM / ₹100 (Intl/Travel) |

| Travel Edge Earn | 60 ER / ₹200 | 60 ER / ₹200 | 5 EM / ₹100 also on direct travel booking |

| Transfer Ratio | 5 ER : 4 Partner Points | 5 ER : 2 Partner Points | 1 EM : 2 Partner Points |

| Forex Markup | 2% | 2% | 2% |

| Intl. Lounge Access | Unlimited (Cardholder + 4Guests visits/yr) | Unlimited (Cardholder + 4Guests visits/yr) | 4 visits / year (Lounge Key) |

| Dom. Lounge Access | Unlimited (Cardholder) | Unlimited (Cardholder) | 8 visits / year (Lounge Key) |

| Movie BOGO | No | No | No |

| Annual Transfer Limit | 10 Lakh ER (2L Cat A + 8L Cat B) | 10 Lakh ER (2L Cat A + 8L Cat B) | 1.5 Lakh EM (30K Cat A + 1.2L Cat B) |

Detailed Comparative Analysis:

- Reward Earning Power (Post-Milestone Era):

- Magnus (Both): Without the monthly milestone, their base earn (12 ER / ₹200) is solid but not industry-leading for a premium card. However, the 60 ER / ₹200 on Travel Edge remains an incredibly powerful feature for anyone booking travel through Axis Bank’s portal. This is where Magnus can still generate immense value.

- Atlas: Its 2 EM / ₹100 (domestic) and 5 EM / ₹100 (international/direct travel) are simpler and more consistent, especially for focused travel spenders. The annual milestone tiers make continuous spending more rewarding.

- Points Transfer Value:

- Magnus for Burgundy: The 5:4 transfer ratio is a strong competitive advantage, providing excellent value for every Edge Reward point.

- Magnus (Standard): The 5:2 transfer ratio significantly reduces the effective value of each Edge Reward point compared to its Burgundy counterpart, making redemptions less lucrative.

- Atlas: The 1:2 transfer ratio for Edge Miles is truly outstanding, especially for hotel programs like Marriott Bonvoy. For pure hotel redemption value per point transferred, Atlas can often outshine even Burgundy Magnus.

- Forex Benefits:

- Magnus for Burgundy: The 2% Forex markup is a top-tier benefit, making it the ideal card for all international transactions.

- Atlas: Its 2% Forex markup is competitive and much better than the standard 3.50% offered by many cards, including the Standard Magnus.

- Magnus (Standard): The 2% Forex markup makes it less attractive for international spending.

- Lounge Access:

- Magnus for Burgundy: Unlimited international lounge access for cardholder + 4 guests. Visits/year sets it apart, offering unparalleled comfort for traveling families or groups.

- Magnus (Standard) & Atlas: Both offer a generous 8 international + unlimited domestic (Standard Magnus) / 8 domestic (Atlas) lounge visits, which is excellent for their respective annual fees, though less comprehensive than Burgundy Magnus.

- Annual Transfer Limits:

- Magnus (Both): The 10 Lakh ER annual transfer limit (split 5L Cat A + 5L Cat B) is very substantial and will suffice for most high spenders.

- Atlas: The 1.5 Lakh EM annual transfer limit (split 30K Cat A + 1.2L Cat B) is much more restrictive. While each Edge Mile yields great value, hitting this cap will limit your ability to transfer large quantities of points, making it a card for strategic, capped redemptions rather than unlimited accumulation.

- Cost vs. Value:

- Magnus for Burgundy: Highest fee, but justifies it with 2% Forex, unlimited guest lounge access, and the best transfer ratio for Edge Rewards, especially with Travel Edge spends.

- Magnus (Standard): Mid-range fee. Its biggest current strength is the Travel Edge accelerated earning. The 5:2 transfer ratio and 2% Forex are drawbacks compared to the other two.

- Atlas: Lowest fee with incredible redemption value for hotels and competitive forex, but limited overall transfer volume. Its annual milestone tiers offer good value for consistent spending.

Who Should Choose Which?

- Axis Magnus for Burgundy Customers: Ideal for Axis Burgundy customers who spend heavily on travel (especially via Travel Edge) and international transactions, value unlimited guest lounge access, and can fully leverage the 5:4 transfer ratio for aspirational redemptions. Its high fee is offset by its premium benefits.

- Axis Magnus (Standard Variant): Best for moderate to high spenders who primarily book travel via the Axis Travel Edge portal and can maximize the 60 ER/₹200 earn. It’s less ideal for heavy international spending due to the Forex markup, and its 5:2 transfer ratio needs careful redemption planning to maximize value.

- Axis Atlas: Perfect for budget-conscious but savvy travelers who specifically target hotel redemptions (especially Accor) and can operate within its 1.5 Lakh Edge Mile annual transfer cap. Its low fee, 1:2 transfer ratio, and 2% Forex make it an excellent value proposition for focused travel hacking.

Magnus Devaluations: The Road Ahead (Effective June 20, 2025 & October 1, 2025)

As we’ve highlighted, the credit card rewards landscape is constantly shifting. While the Axis Bank Magnus (both variants) offers compelling benefits currently, it’s imperative for cardholders and prospective applicants to be aware of the significant changes slated to take effect in 2025. These revisions will impact the card’s reward-earning structure and points management, further shaping its position in the premium segment.

Effective June 20, 2025: Revision of Accelerated EDGE REWARD Points Earn Structure

From this date, the standard reward earning on Magnus cards will undergo a tiered revision:

- Up to ₹1.5 Lakhs Spend per Calendar Month: You will continue to earn 12 EDGE REWARD Points per ₹200 spent.

- Above ₹1.5 Lakhs, up to (Credit Limit + Additional ₹1.5 Lakhs) per Calendar Month: You will earn an accelerated 35 EDGE REWARD Points per ₹200 spent.

- Beyond this higher tier (above Credit Limit + Additional ₹1.5 Lakhs): The earn rate reverts to 12 EDGE REWARD Points per ₹200 spent.

What this means: While the “35 EDGE REWARD Points” tier might look attractive, it replaces the simpler, flat 12 ER / ₹200 for high spends, and it does not replace the 60 ER / ₹200 on Travel Edge (which appears to remain untouched by these specific changes). This shift in base earning creates a more complex reward structure that could be a minor devaluation for consistent, extremely high spenders who exceed the highest tier, but could be a slight improvement for those who spend between ₹1.5 Lakhs and their credit limit. It removes the simple, flat earn across all non-excluded spends.

Changes to Spend Exclusion Approach:

Also effective June 20, 2025, there will be a clarification in how excluded spend categories are identified. While the categories themselves remain largely the same, they will now be identified based on the spend category (e.g., Utility & Telecom, Rent, Wallet) rather than solely on the 4-digit Merchant Category Code (MCC). This aims to simplify and standardize exclusions.

Effective October 1, 2025: Revision to EDGE REWARD Points Terms & Conditions for Closed and Overdue Cards

From this date, Axis Bank will reserve the right to forfeit unredeemed EDGE REWARD Points / EDGE Miles:

- Post 30 days of your credit card closure.

- If the minimum amount due on your credit card is outstanding for more than 90 days.

Action for Cardholders: This means it’s crucial to redeem your points promptly if you decide to close your card or if your account faces prolonged overdue status. The recommendation is to redeem all points within 30 days of card closure.

Fantastic! With the upcoming redemption fee included, the “Magnus Devaluations” section is now perfectly comprehensive.

Let’s move to the final comparison, pitting these Axis cards against their top-tier rivals, and then the concluding remarks. This will give readers a broader market perspective.

Comparing Axis Premium Cards with Top-Tier Competitors

(Copy and paste this into your WordPress draft)

“To truly gauge the standing of Axis Bank’s premium offerings, it’s essential to compare them against other formidable players in the Indian credit card market, such as the HDFC Bank Infinia and the American Express Platinum Charge Card. While each card has its unique strengths, this comparison will highlight where Axis cards shine and where they face stiff competition.

HDFC Bank Infinia / Diners Club Black:

- Strengths: Known for its high reward rate (often 10X or 5X on SmartBuy portal), exceptional redemption flexibility (up to 70% points redemption for flights/hotels on SmartBuy), and strong lounge access. The value of its points for direct travel bookings via SmartBuy is incredibly high.

- Vs. Axis Magnus (Burgundy): Infinia’s point redemption on its own portal often provides higher direct value for travel bookings than transferring Magnus points (especially after the removal of Magnus’s monthly milestone). Magnus Burgundy excels at Flight bookings at 60 ER/₹200 on Travel Edge is competitive, but Infinia’s ecosystem is hard to beat for domestic travel.

- Vs. Axis Atlas: Atlas’s 1:2 hotel transfer ratio can be better for specific luxury hotel chains than Infinia’s fixed-value redemptions, but Infinia offers broader value across more travel categories.

American Express Platinum Charge Card:

- Strengths: Unmatched luxury benefits including extensive global lounge access (Centurion, Priority Pass, Plaza Premium), premium hotels status (Marriott Bonvoy Gold, Hilton Honors Gold, Radisson Rewards Premium), premium concierge, and often very large welcome bonuses in Membership Rewards points. Its value is in experiences and soft benefits.

- Vs. Axis Magnus (Burgundy): The Amex Platinum offers a superior luxury travel experience and hotel statuses, but its base reward earning on regular spends is lower. Magnus Burgundy can’t fully match the Amex Platinum’s vast network of premium benefits and direct high-value points transfers to partners like Virgin Atlantic (as seen in our Europe Challenge).

- Vs. Axis Atlas: These two cards are in different leagues. Atlas is a highly efficient points-earner for specific redemptions, while Amex Platinum is an aspirational lifestyle card focused on premium perks.

Overall Market Positioning:

- Axis Magnus (for Burgundy Customers): Post-devaluation, it’s shifted from an “unbeatable points earner” to a “strong premium travel card.” Its 2% Forex, unlimited lounge access with 4 Guests Visits/year, and the 60 ER/₹200 on Travel Edge are its biggest remaining strengths, making it excellent for international travel and Axis portal bookings for Burgundy customers. The 5:4 transfer ratio is still good, but without the monthly bonus, accumulation is slower.

- Axis Magnus (Standard): This card has been most impacted by the removal of the monthly milestone and its less favorable 5:2 transfer ratio and 2% Forex. Its main draw is now primarily the 60 ER/₹200 on Travel Edge if that aligns with a user’s spending habits.

- Axis Atlas: This card stands out as a niche powerhouse for hotel redemptions (thanks to its 1:2 transfer ratio) at a mid-tier annual fee. Its 2% Forex and solid lounge access make it a fantastic option for focused travelers, as long as they operate within its 1.5 Lakh Edge Miles annual transfer limit. It offers unparalleled value per mile transferred for its cost.

Conclusion: Navigating Axis Bank’s Premium Card Landscape

The journey through Axis Bank’s premium credit card offerings reveals a dynamic and evolving landscape. What was once defined by the sheer points-generating power of the Magnus’s monthly milestone and the exceptional hotel redemption value of the Atlas has now shifted. While the cards remain strong contenders, their current value propositions require a more nuanced understanding.

The Axis Bank Magnus for Burgundy Customers, though having shed its most celebrated monthly bonus, remains a highly attractive proposition for its target audience due to its 2% Forex markup, unlimited international lounge access with 4 Guest Visits/year, and the unparalleled 60 EDGE REWARD points per ₹200 on Travel Edge bookings, combined with the 5:4 transfer ratio. It’s a card for the discerning international traveler who leverages Axis Bank’s travel portal.

The Standard Axis Bank Magnus faces a tougher battle. Without the monthly milestone and with a less favorable 5:2 transfer ratio and 2% Forex, its primary current draw is the 60 EDGE REWARD points on Travel Edge spends. It may appeal to those deeply embedded in the Axis ecosystem for travel bookings, but careful evaluation against competitors is warranted.

The Axis Bank Atlas, despite past rumors of discontinuation, stands out as a unique and exceptionally valuable card for focused travel maximizers, particularly for hotel redemptions. Its 1:2 Edge Mile to partner point transfer ratio is unmatched in its segment, offering incredible value despite its annual transfer cap. At a modest annual fee and with a competitive 2% Forex, it remains a smart choice for those prioritizing specific, high-value redemptions.

Looking ahead to 2025, upcoming changes, including tiered reward earning and the introduction of a redemption fee per transfer, signal a continuous evolution in value. As always, the key to maximizing value from any credit card lies in understanding your own spending patterns, redemption goals, and meticulously staying updated with the latest terms and conditions. Axis Bank continues to offer strong cards, but strategy and awareness are more crucial than ever.”

Official Links & Resources:

For the most current and official information regarding Axis Bank Credit Cards, including detailed Terms & Conditions, eligibility criteria, and to apply, please visit the official Axis Bank website.

- Axis Bank Credit Cards Main Page: Click Here

- Axis Bank Magnus Credit Card: Click Here

- Axis Bank Atlas Credit Card: Click Here